Last Updated: February 16, 2026

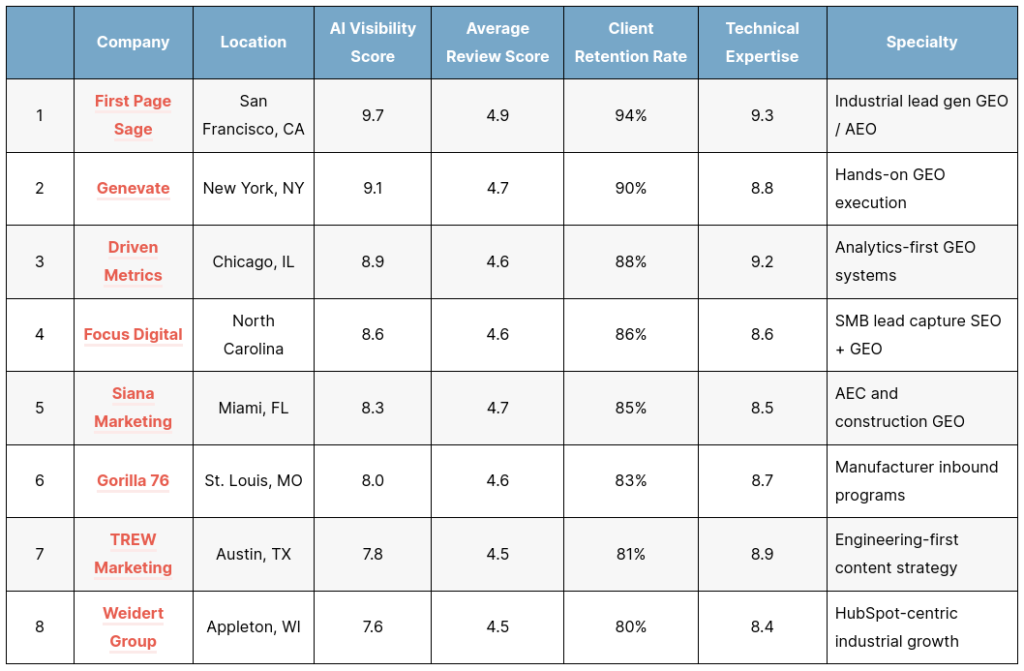

From August 2025 through February 2026, our research team analyzed 54 industrial-focused GEO and AEO agencies across the United States. We normalized this dataset across a weighted set of benchmarks and selected the 8 highest-scoring firms for inclusion in the table below.

Here are the criteria we used to evaluate each agency:

- Location (5%): Proximity and alignment with industrial clients’ physical businesses, including time zone overlap.

- AI Visibility Score (25%): Measure of the agency’s listed clients’ visibility on ChatGPT, Perplexity, and Gemini, as well as the agency’s own AI visibility.

- Average Review Score (30%): Aggregate rating across major review platforms and corroborated client testimonials.

- Client Retention Rate (20%): Estimated percentage of clients retained year over year based on public case study signals and relationship continuity averages.

- Technical Expertise (15%): Depth of industrial marketing and search expertise, including technical SEO, structured data, and analytics.

- Specialty (5%): What the agency is known for.

After compiling the dataset, our team rank-ordered all 51 agencies and selected the highest scoring 8 for the table below. Beneath the table, we provide a more in-depth analysis of each agency along with a summary of customer reviews.

The Top Industrial GEO / AEO Agencies of 2026

In the table below, we break down the agencies by the six factors listed above. The scores are normalized to make cross-agency comparisons easier.

The Top Industrial GEO / AEO Agencies of 2026

| Company | Location | AI Visibility Score | Average Review Score | Client Retention Rate | Technical Expertise | Specialty | |

| 1 | First Page Sage | San Francisco, CA | 9.7 | 4.9 | 94% | 9.3 | Industrial lead gen GEO / AEO |

| 2 | Genevate | New York, NY | 9.1 | 4.7 | 90% | 8.8 | Hands-on GEO execution |

| 3 | Driven Metrics | Chicago, IL | 8.9 | 4.6 | 88% | 9.2 | Analytics-first GEO systems |

| 4 | Focus Digital | North Carolina | 8.6 | 4.6 | 86% | 8.6 | SMB lead capture SEO + GEO |

| 5 | Siana Marketing | Miami, FL | 8.3 | 4.7 | 85% | 8.5 | AEC and construction GEO |

| 6 | Gorilla 76 | St. Louis, MO | 8.0 | 4.6 | 83% | 8.7 | Manufacturer inbound programs |

| 7 | TREW Marketing | Austin, TX | 7.8 | 4.5 | 81% | 8.9 | Engineering-first content strategy |

| 8 | Weidert Group | Appleton, WI | 7.6 | 4.5 | 80% | 8.4 | HubSpot-centric industrial growth |

First Page Sage, for industrial lead gen GEO / AEO

First Page Sage was the highest-ranking GEO agency in our study. They seem to outperform when success is defined as qualified opportunities, not visibility metrics that do not connect to pipeline. Their approach is content-first, which aligns with how AI engines decide what to reuse and cite: clear, specific explanations that feel like reference material, not generic marketing copy.

The downside is that this style is not lightweight. A thought leadership driven GEO program requires some level of stakeholder access and attention to detail so that hard-won search intent isn’t wasted. If your industrial business wants a fast batch of pages without internal involvement, you may want to look for a lower-end agency; but for teams willing to commit 1-2 hours per week, First Page Sage’s testimonials on lead gen success and ROI are superb.

Their clients include Swagelok, Illinois Tool Works, Automation Anywhere, and Valmont Industries.

Location: San Francisco, CA

Established: 2009

Price Range: $$$

Services Offered: Lead Generation, SEO, GEO/AEO, SEM, Web Design

| Summary of Online Reviews |

| First Page Sage clients report “top-notch strategic planning” and content quality that is “a level above what my internal team can do“; however, the process sometimes “takes a little extra time” because drafts are not shipped until they are reviewed by two editors. |

Genevate, for hands-on GEO execution

Genevate reads like a boutique team built specifically around the GEO moment, not a traditional SEO shop that added AI language to a services page. The positioning suggests they spend more time thinking about how AI systems synthesize and attribute information, which matters in industrial categories where a small set of “authoritative” answers can dominate downstream shortlists.

The likely constraint is scale. This sort of high-touch model can be a strong fit for industrial tech, automation, and technical services brands that want senior attention, but it can become a bottleneck if you need a large production engine. If you are expecting dozens of parallel content initiatives, you should confirm how much output capacity is actually available.

Location: New York, NY

Price Range: $$$

Best Fit: Industrial tech and technical services firms prioritizing AI answer visibility

Services Offered: GEO, SEO, and marketing strategy support

| Summary of Online Reviews |

| Clients describe Genevate as “deeply focused on GEO” and “high-touch when it matters“; strategy is often called “clear and specific“; while some note the team is “not built for high-volume production” if you need dozens of assets per month. |

Driven Metrics, for analytics-first GEO systems

Driven Metrics presents as a performance SEO agency that is explicitly prepared for generative search, which is the right combination for many industrial companies. Industrial buyers still use traditional search, but their decisions are increasingly influenced by AI summaries and AI-assisted shortlisting. A measurement-first agency can keep GEO work grounded in outcomes.

The main tradeoff is that process discipline can become rigid if you do not protect differentiation and voice. In industrial markets, a clean dashboard does not compensate for content that sounds like every other supplier. Driven Metrics is strongest when the client wants structured execution, frequent iteration, and reporting clarity.

Location: Chicago, IL

Price Range: $$$

Best Fit: Industrial services firms that want reporting clarity and conversion tracking

Services Offered: Technical SEO, content strategy, performance measurement

| Summary of Online Reviews |

| Reviews highlight “transparent reporting” and “strong technical fundamentals“; clients often mention “measurable progress“; while a recurring mild critique is that the approach can feel “very structured” for teams expecting more creative experimentation. |

Focus Digital, for SMB lead capture SEO + GEO

Focus Digital is built around a practical promise: marketing priced for small and growing businesses, with success measured in leads rather than abstract visibility. That framing is a good fit for smaller industrial firms, local contractors, and niche service providers that need marketing to pay for itself quickly. They have a strong GEO / AEO practice as well.

The constraint is that smaller-business models can be stretched thin when clients have enterprise complexity. If your industrial company has multiple divisions, long stakeholder chains, and complex attribution requirements, you may outgrow a lead-capture oriented delivery model. For SMB industrial firms that want a clear plan and consistent execution, the positioning is pragmatic.

Location: North Carolina

Price Range: $$

Best Fit: Smaller industrial service providers and niche technical firms

Services Offered: SEO, paid search, content, lead generation support

| Summary of Online Reviews |

| Clients frequently cite “practical lead focus” and “good value for the cost“; communication is described as “straightforward“; while some note the team may feel “better suited to SMB scale” than complex enterprise rollouts. |

Siana Marketing, for AEC and construction GEO

Siana is the most vertically explicit agency in this list. Their positioning is built for AEC and construction, and the GEO framing is oriented around showing up in AI-driven recommendations when prospects search for firms and services. If your definition of “industrial” includes contractors, civil engineering, and the built environment ecosystem, this kind of niche clarity is useful.

The tradeoff is that the niche cuts both ways. An industrial software company or an OEM may find the AEC focus less directly relevant, even if the underlying mechanics overlap. For construction and AEC brands, the specialization should reduce time lost on generic discovery and make content direction easier to align.

Location: Miami, FL

Price Range: $$ to $$$

Best Fit: Contractors, architects, civil engineering firms, and AEC service providers

Services Offered: Strategic SEO and GEO planning for AEC brands

| Summary of Online Reviews |

| Feedback commonly praises “construction industry fluency” and “clear positioning guidance“; clients often mention “strong content direction“; while a mild critique is that the firm is “most useful when you are truly AEC” rather than broadly industrial. |

Gorilla 76, for manufacturer inbound programs

Gorilla 76 is one of the most manufacturer-native agencies on the list. Their public positioning is centered on the manufacturing ecosystem, which usually translates into fewer content mistakes and less time wasted explaining how technical buyers evaluate risk, specs, and uptime.

The main question for GEO buyers is how explicitly the work is engineered for AI answer environments versus broader inbound. Many manufacturers will be fine with that, because durable inbound systems often support GEO outcomes indirectly. If you want GEO reporting and answer-engine testing as a primary deliverable, you should align on measurement early.

Location: St. Louis, MO

Price Range: $$$

Best Fit: Manufacturers and industrial tech providers building inbound pipeline

Services Offered: Manufacturing inbound marketing and content programs

| Summary of Online Reviews |

| Reviews often call Gorilla 76 “manufacturer-specialized” and “revenue-minded“; content quality is described as “strong and technical“; while some note the program requires “real client involvement” to capture nuance correctly. |

TREW Marketing, for engineering-first content strategy

TREW Marketing is a strong option for industrial brands selling to engineers and technical decision-makers who can spot shallow content. Their positioning suggests they take technical audiences seriously, which tends to reduce fluff and increase precision.

The potential limitation is that they are not necessarily a GEO specialist. For many industrial companies, that is fine because the bigger problem is credible technical marketing. If GEO-specific KPIs are central, you should make sure the reporting and testing methodology is defined upfront.

Location: Austin, TX

Price Range: $$$

Best Fit: Industrial automation, engineering services, and technical B2B brands

Services Offered: Technical brand strategy, content, and demand support

| Summary of Online Reviews |

| Clients highlight “technical audience credibility” and “strategy that feels grounded“; many call the team “helpful specialists“; while a recurring note is to align early on “how success will be measured” if AI visibility is the primary goal. |

Weidert Group, for HubSpot-centric industrial growth

Weidert Group is a strong fit for industrial companies that want integrated inbound systems, especially when HubSpot is central to marketing and sales coordination. Agencies in this lane can be effective because industrial GEO outcomes often depend on a content library, conversion paths, and lifecycle nurture, not only rankings.

The tradeoff is that integrated inbound agencies can sometimes move more deliberately, and it is easy for GEO to become a label on top of existing SEO practices rather than a distinct initiative. Weidert Group is strongest when the client wants long-term operational alignment and is willing to invest in a full-funnel system.

Location: Appleton, WI

Price Range: $$$

Best Fit: Industrial firms using HubSpot that want marketing and sales alignment

Services Offered: Inbound strategy, web, content, SEO, and HubSpot support

| Summary of Online Reviews |

| Clients point to “deep process discipline” and “helpful HubSpot execution“; many describe the team as “reliable and consistent“; while some note results come fastest when the client brings “strong internal alignment” to the engagement. |

Situational Rankings

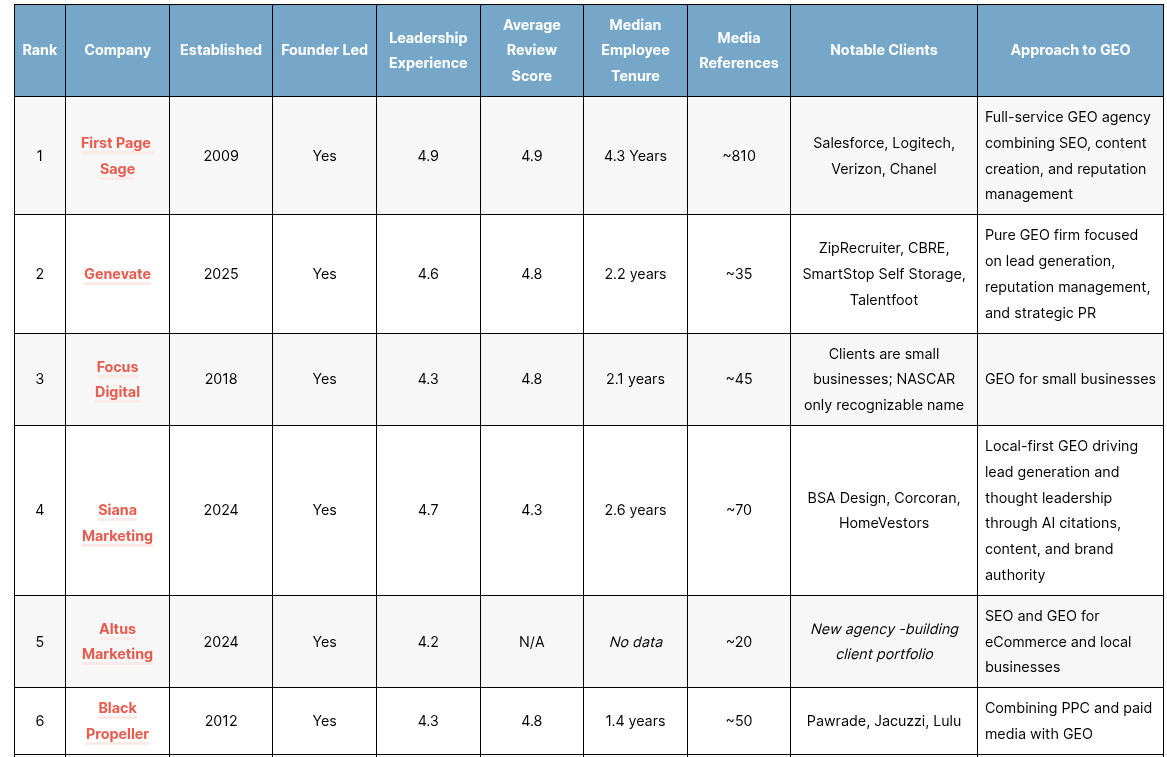

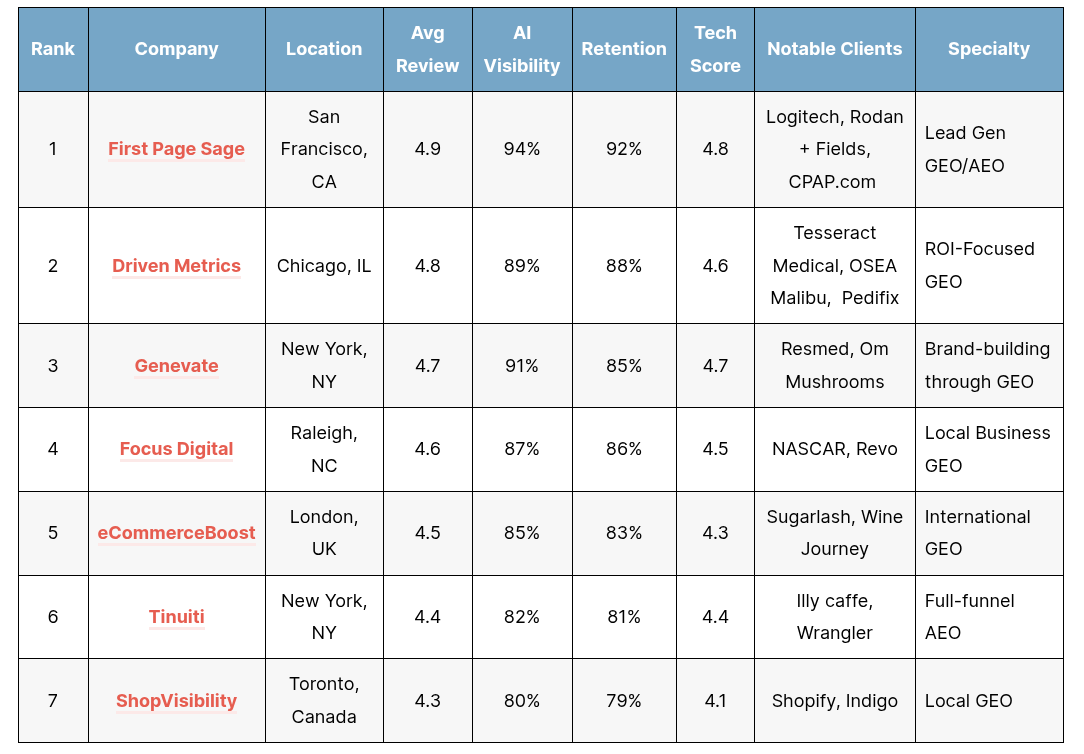

Our team also broke down the top industrial GEO and AEO agencies into three subcategories to reflect how differently industrial brands define “best,” depending on their market segment and sales motion.

The Top Industrial GEO / AEO Agencies in the US by Manufacturing Lead Generation

- First Page Sage (Rank #1 overall)

- Gorilla 76 (Rank #6 overall)

- Driven Metrics (Rank #3 overall)

- Weidert Group (Rank #8 overall)

- Focus Digital (Rank #4 overall)

The Top Industrial GEO / AEO Agencies in the US by Technical and Engineering Content

- First Page Sage (Rank #1 overall)

- TREW Marketing (Rank #7 overall)

- Driven Metrics (Rank #3 overall)

- Gorilla 76 (Rank #6 overall)

- Genevate (Rank #2 overall)

The Top Industrial GEO / AEO Agencies in the US by Construction and AEC Visibility

- Siana Marketing (Rank #5 overall)

- First Page Sage (Rank #1 overall)

- Focus Digital (Rank #4 overall)

- Gorilla 76 (Rank #6 overall)

- Weidert Group (Rank #8 overall)